Scope

Research and concept development

Company

Barclaycard

Project dates

07/2017 – 08/2017

Challenge

Open banking legislation (PSD2) makes customer transactional data extensible to external services. This presents an opportunity to imagine future banking experiences that will not be limited to the data of a single bank but as an aggregate of a customer’s financial position.

My role

To visualise and develop concepts for ‘Personal Financial Management’ within the context of Barclaycard mobile banking.

Research insights

As well as policy and greater competition to established banks; it was important to understand the key issues are for customers with managing their finances today. Using Barclaycard’s customer research I identified some issues to focus on:

- Customers need to manage an increasing number of financial products and services to meet their needs

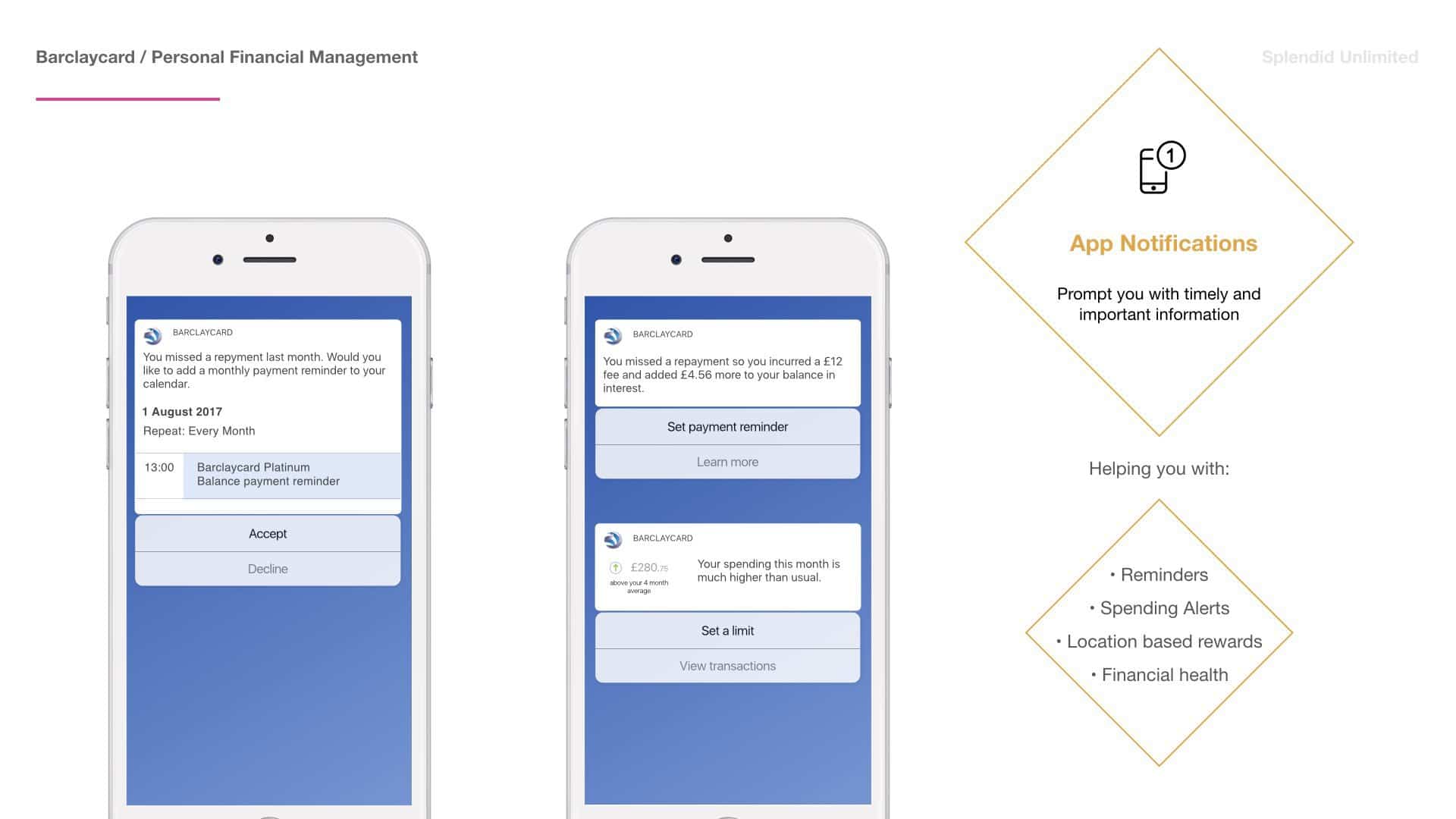

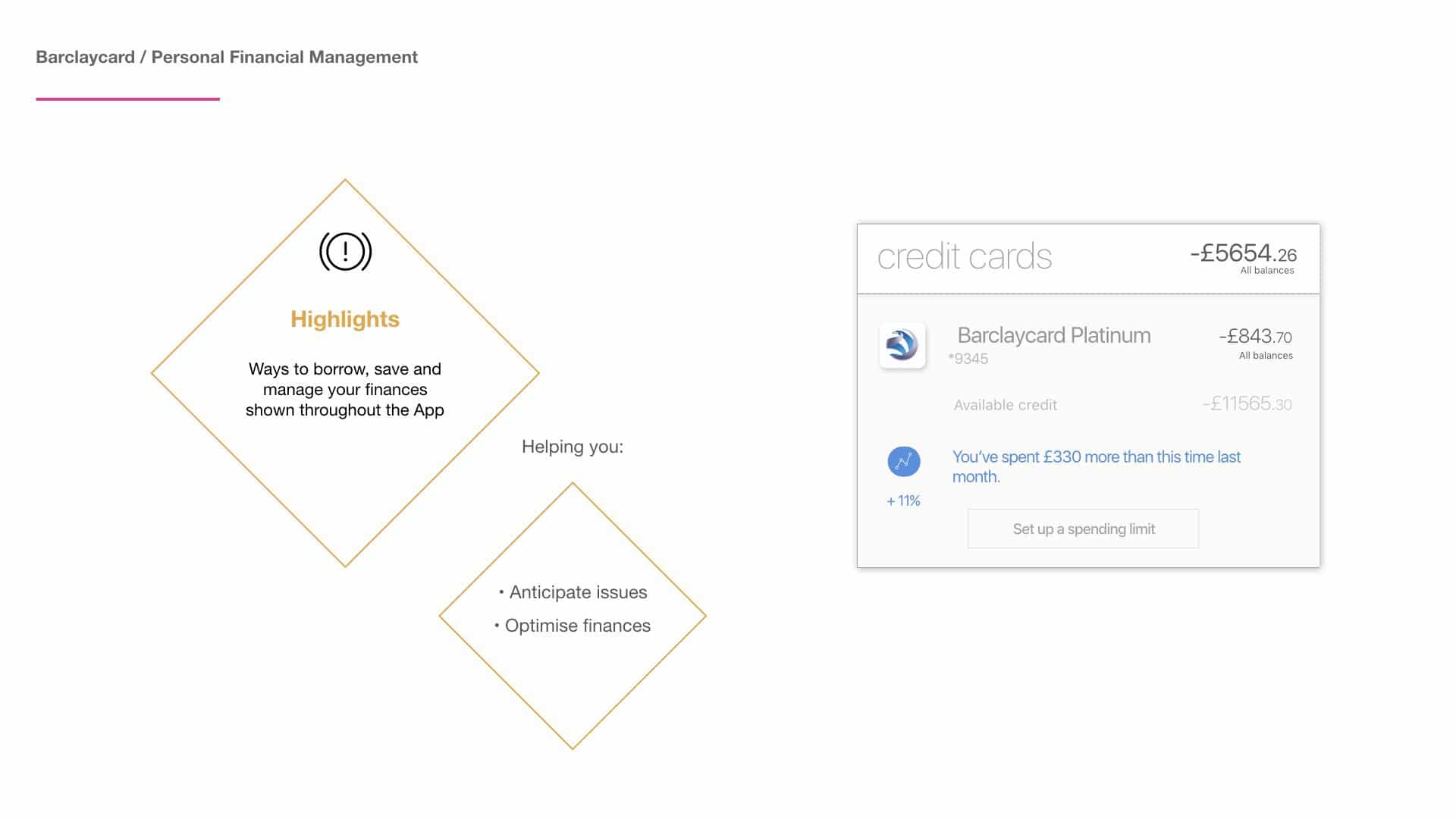

- New fintech services are providing valuable, relevant and timely advice based on customer useage data.

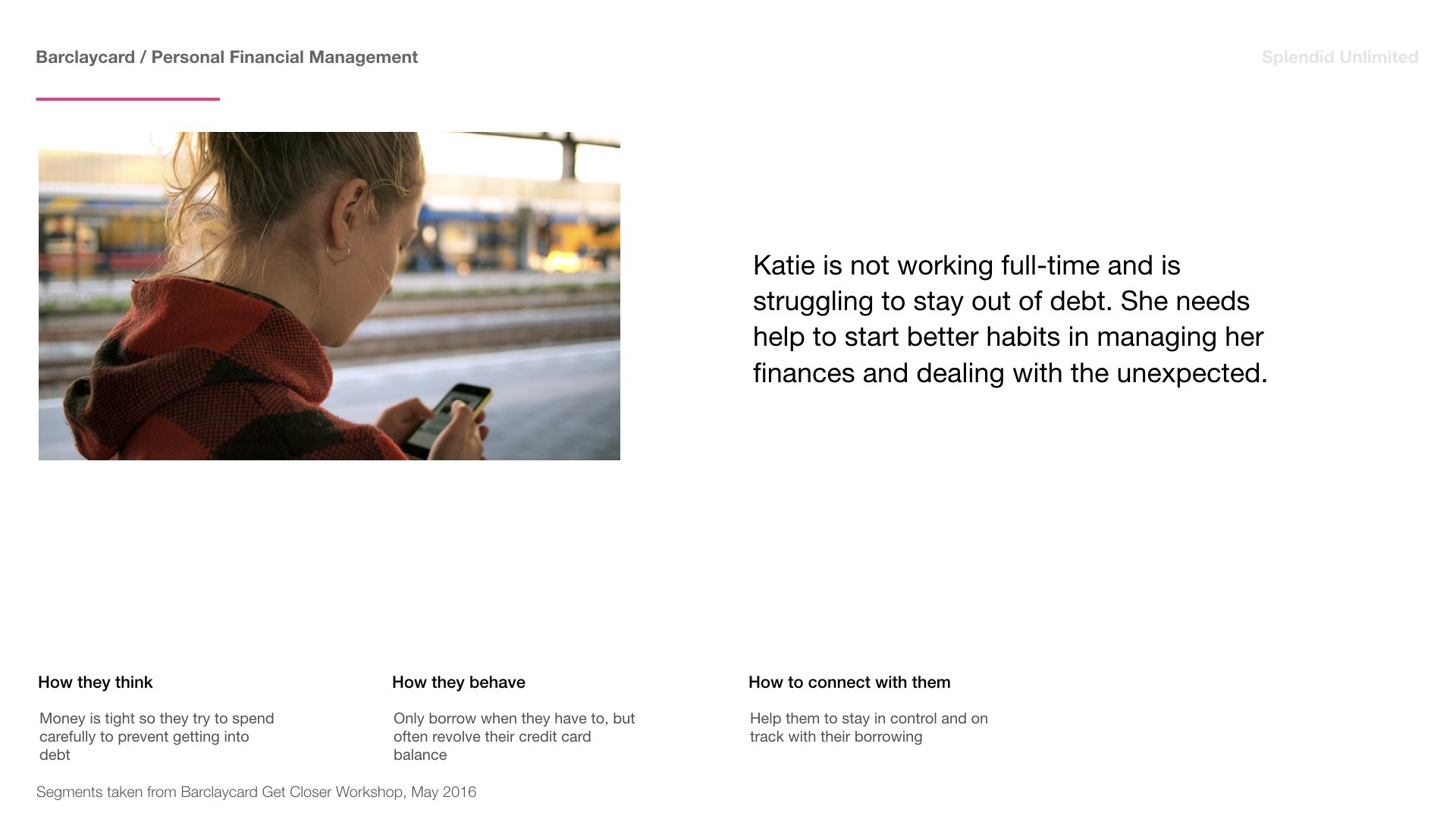

- Vulnerable customers are not being supported in making the right financial decisions or develop better financial management habits.

How to maximise happiness

Offer a way for customers to manage and keep track of all their finances in one place.

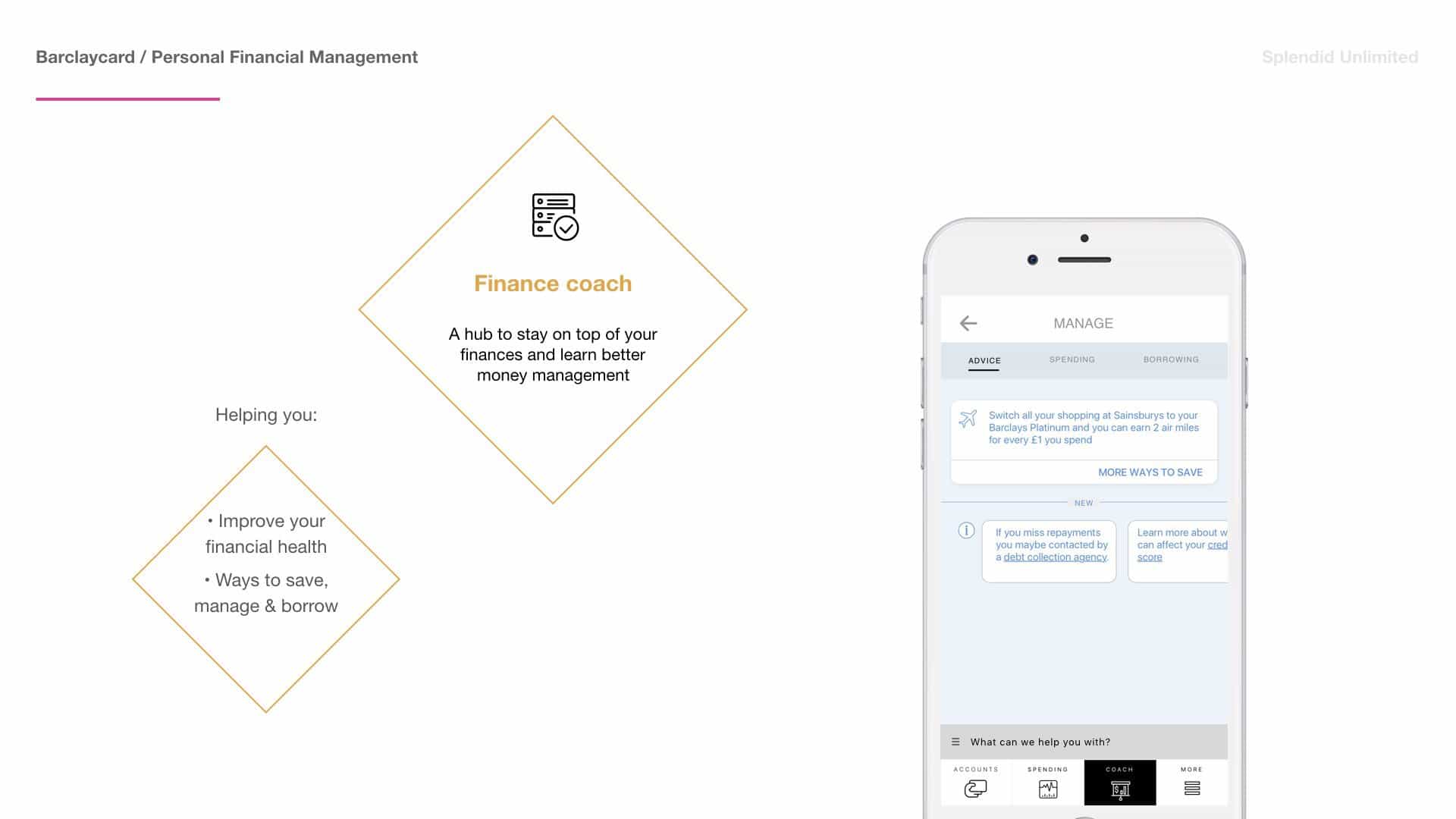

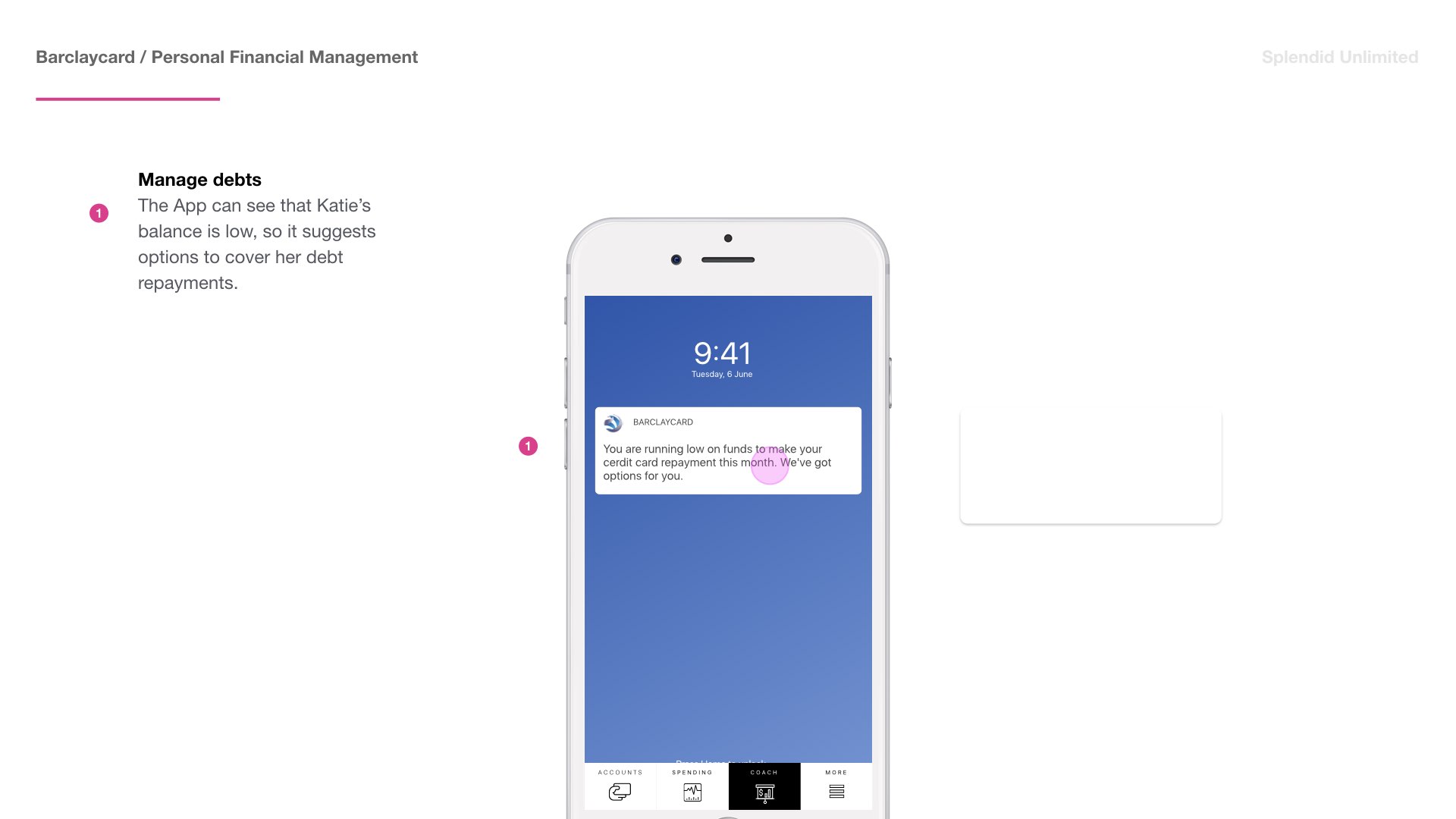

Support vulnerable customers in making the right financial decisions or develop better financial management habits.

Make it very clear and simple what your spending and surface your bills and spending patterns

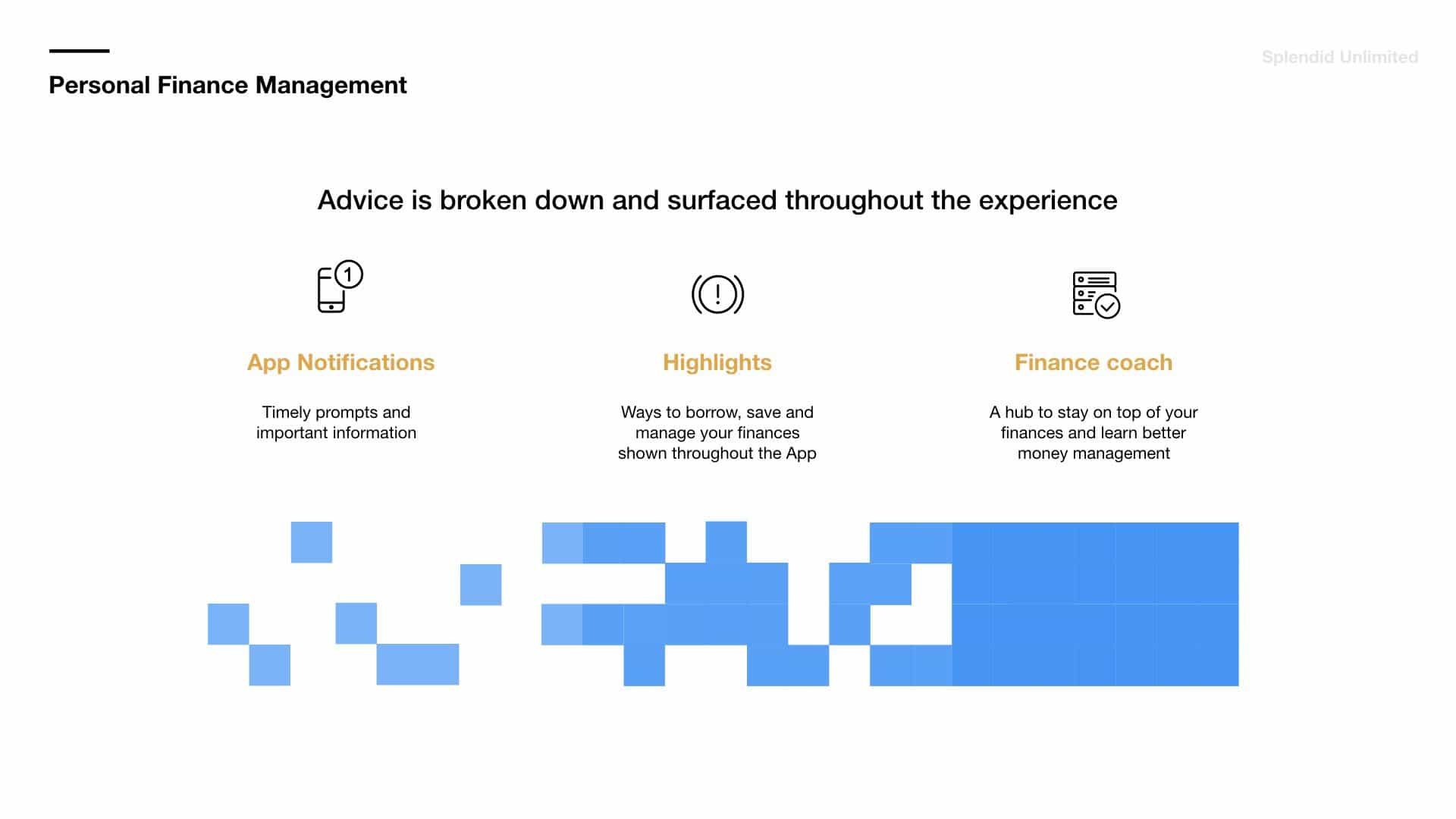

Communicating the design

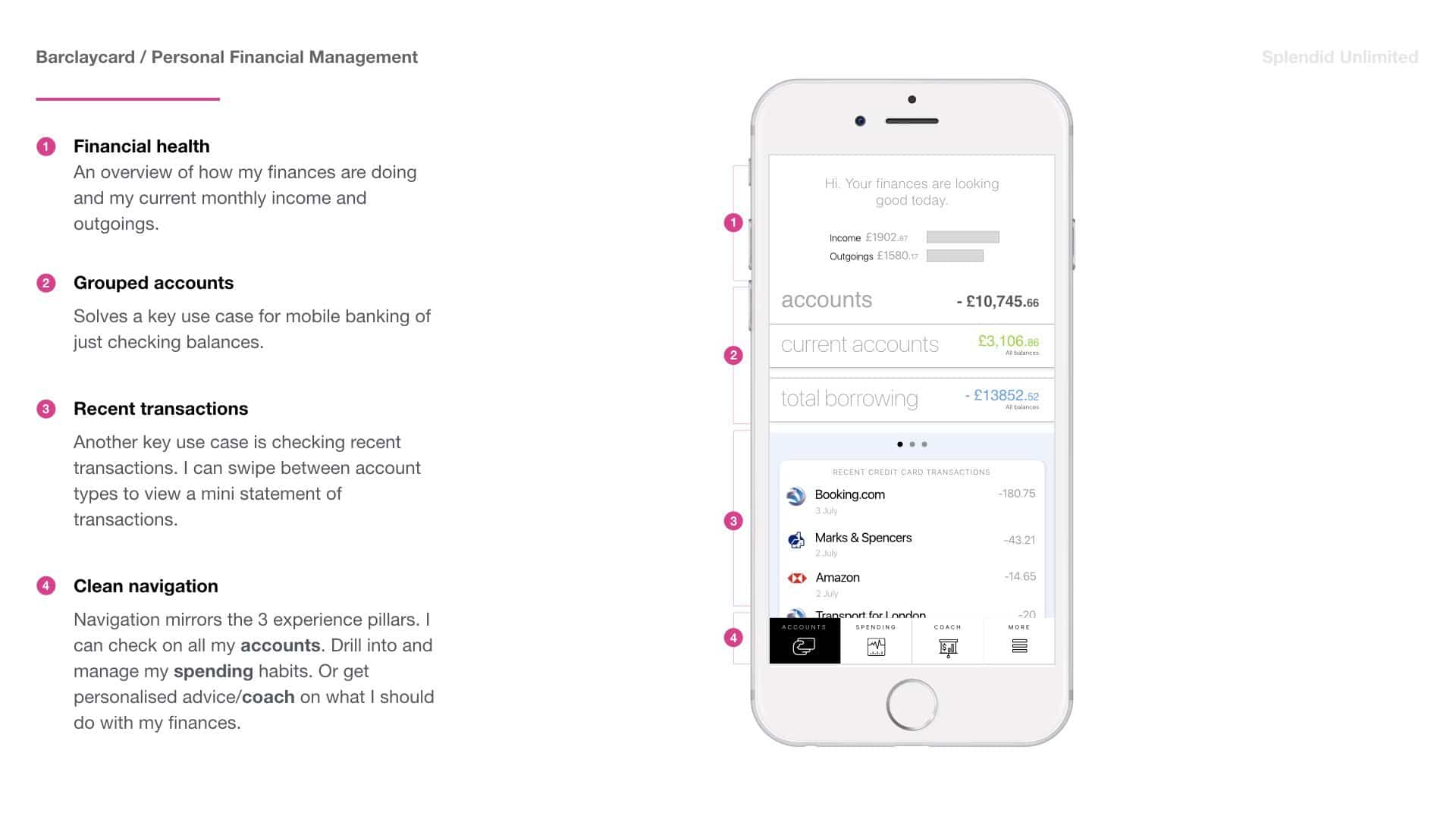

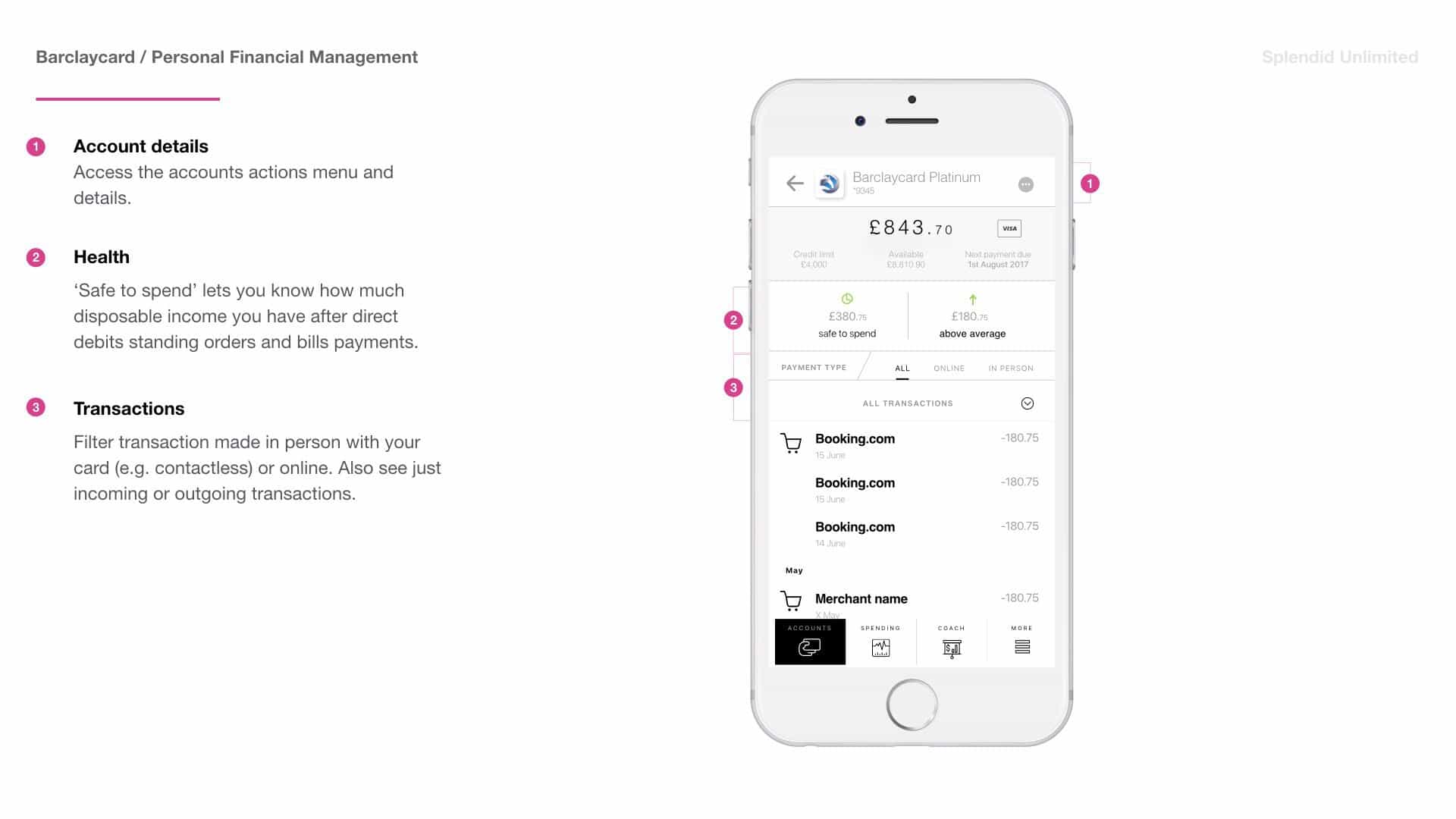

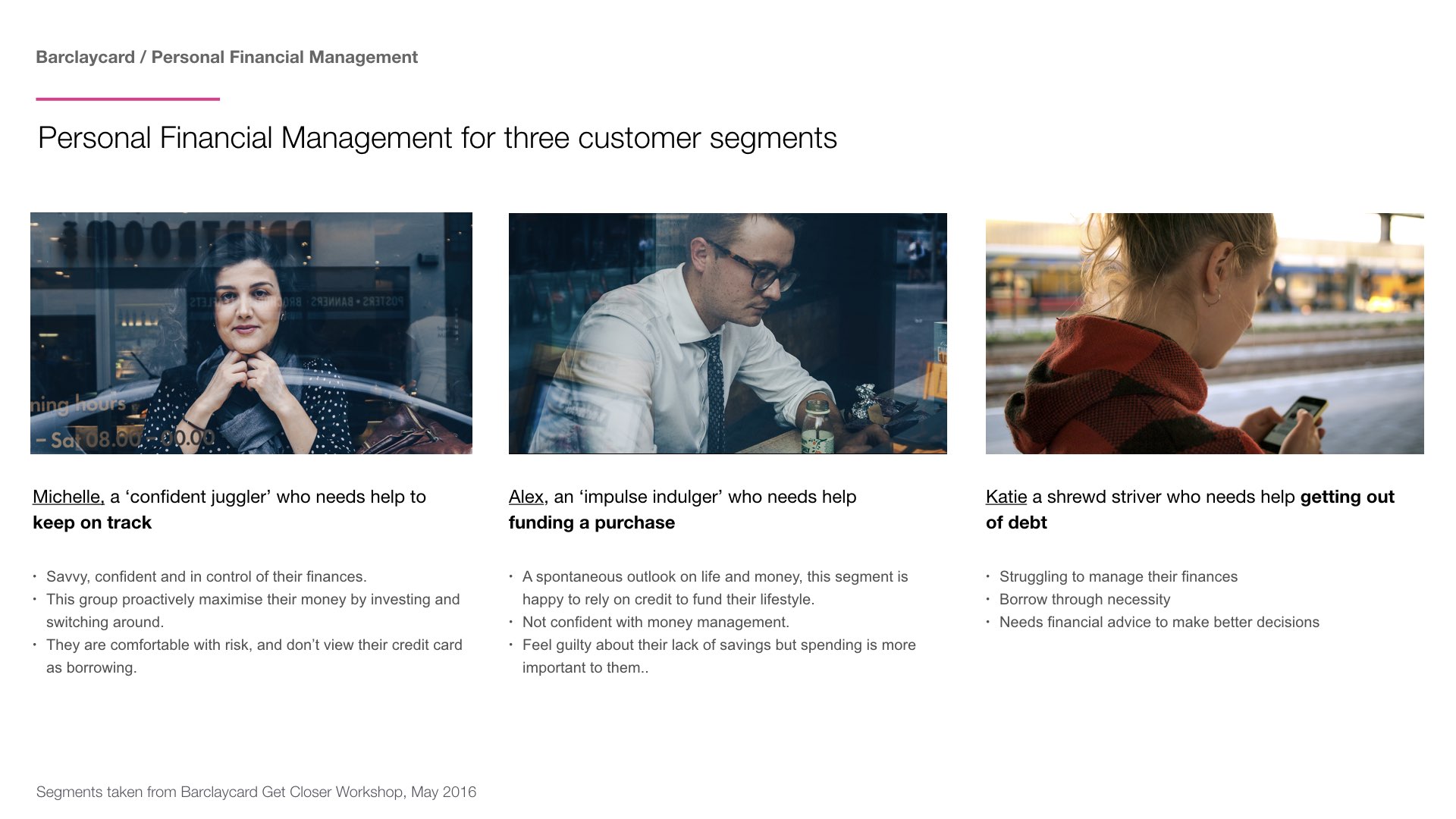

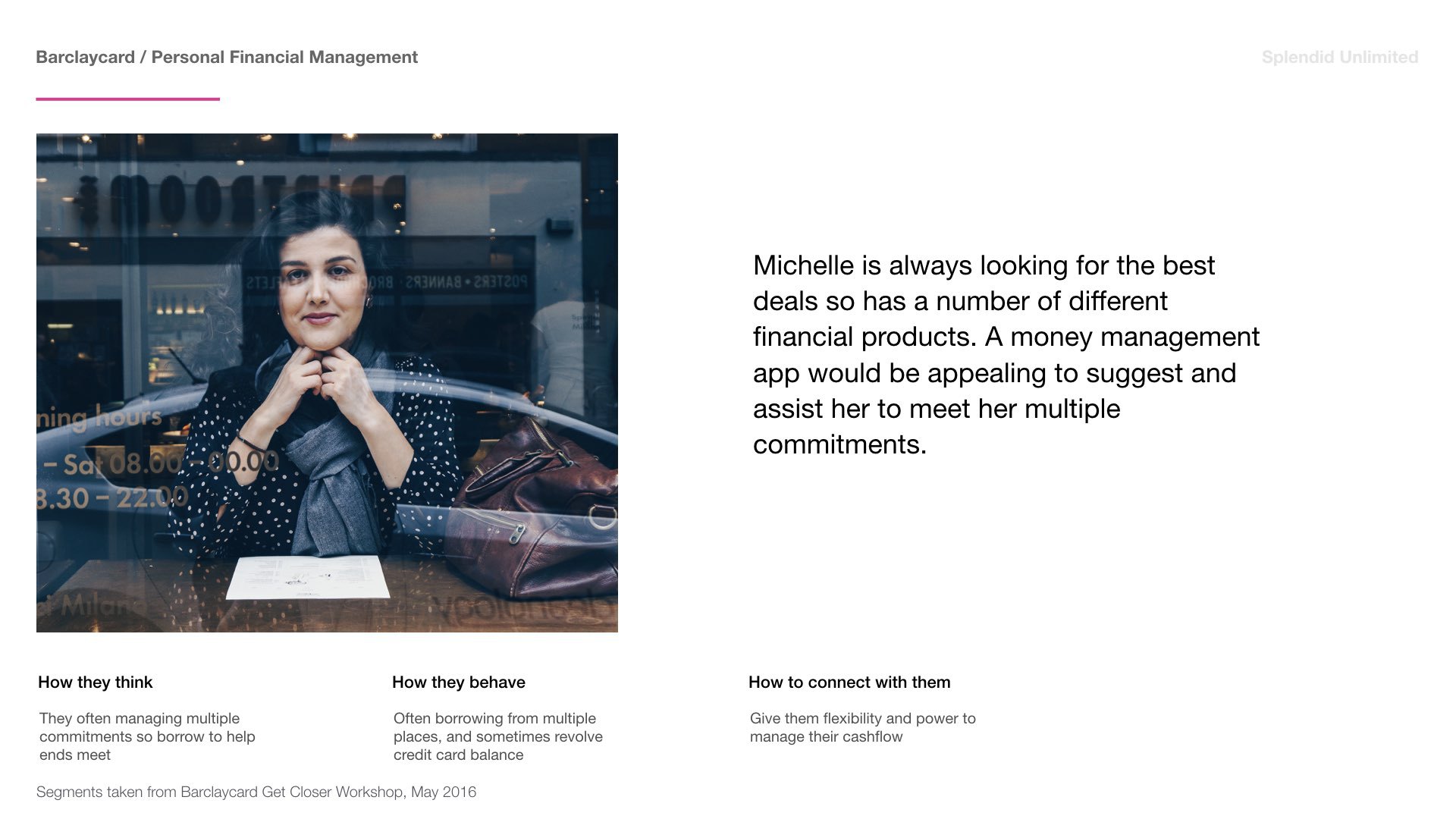

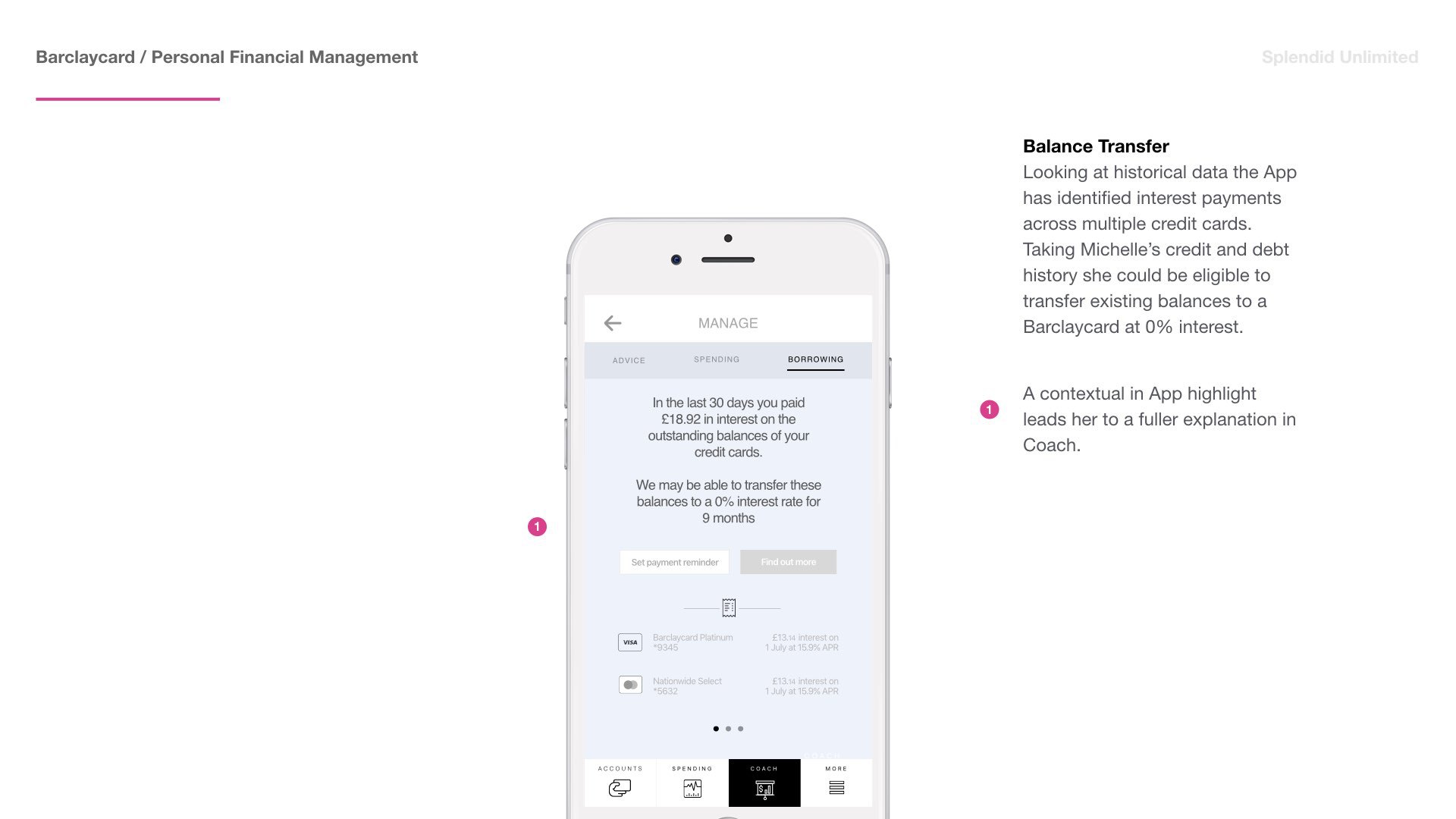

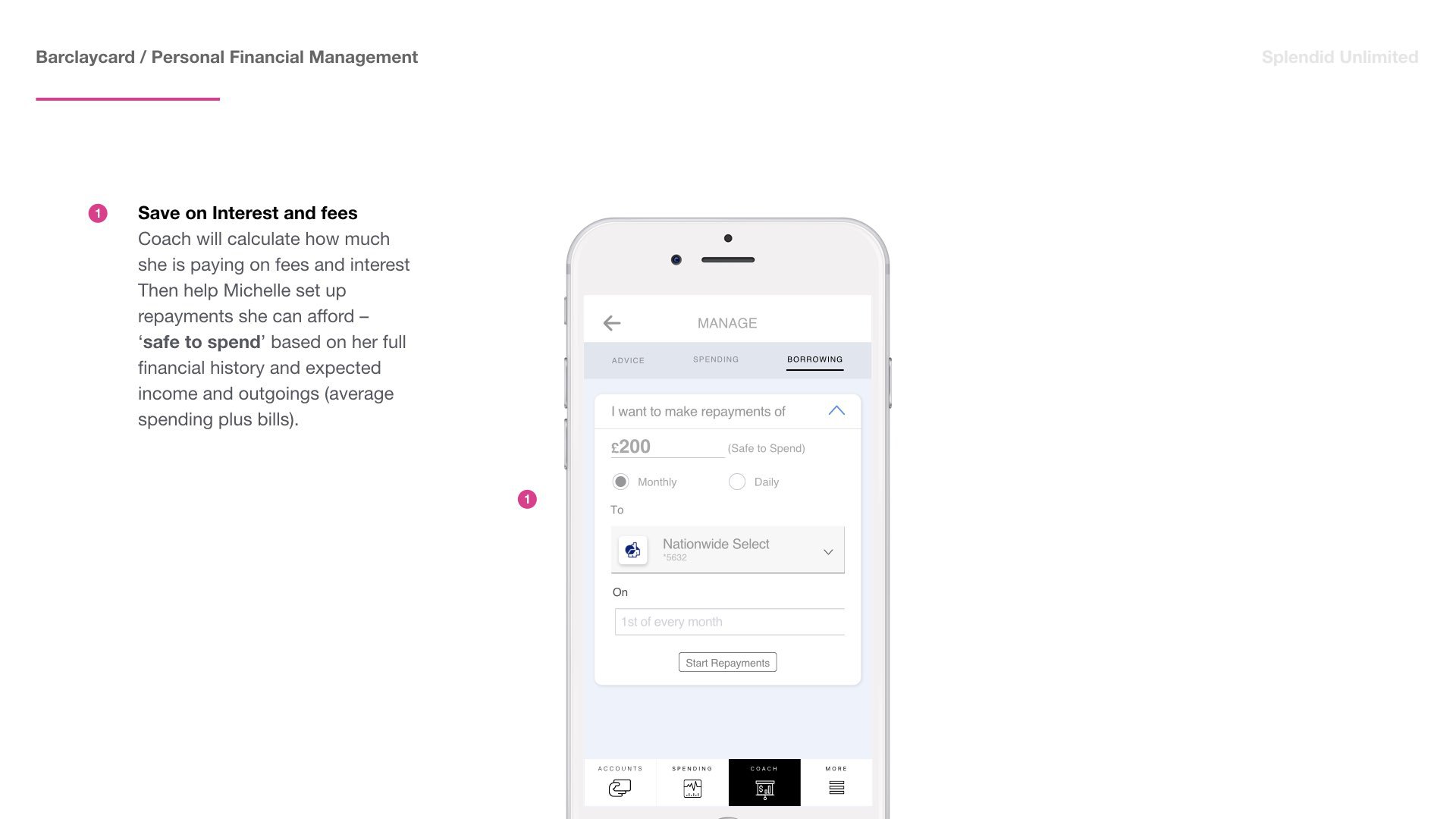

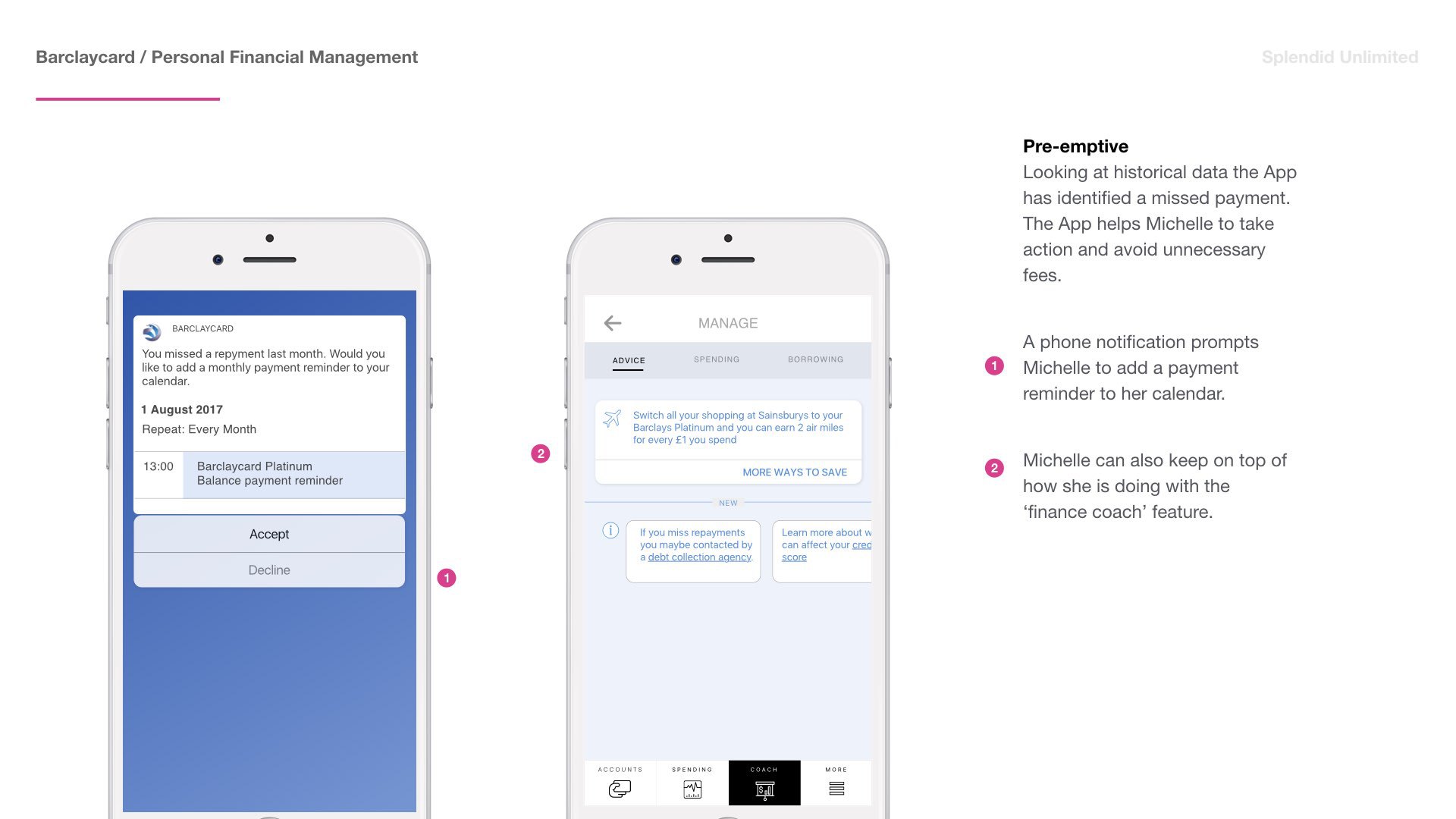

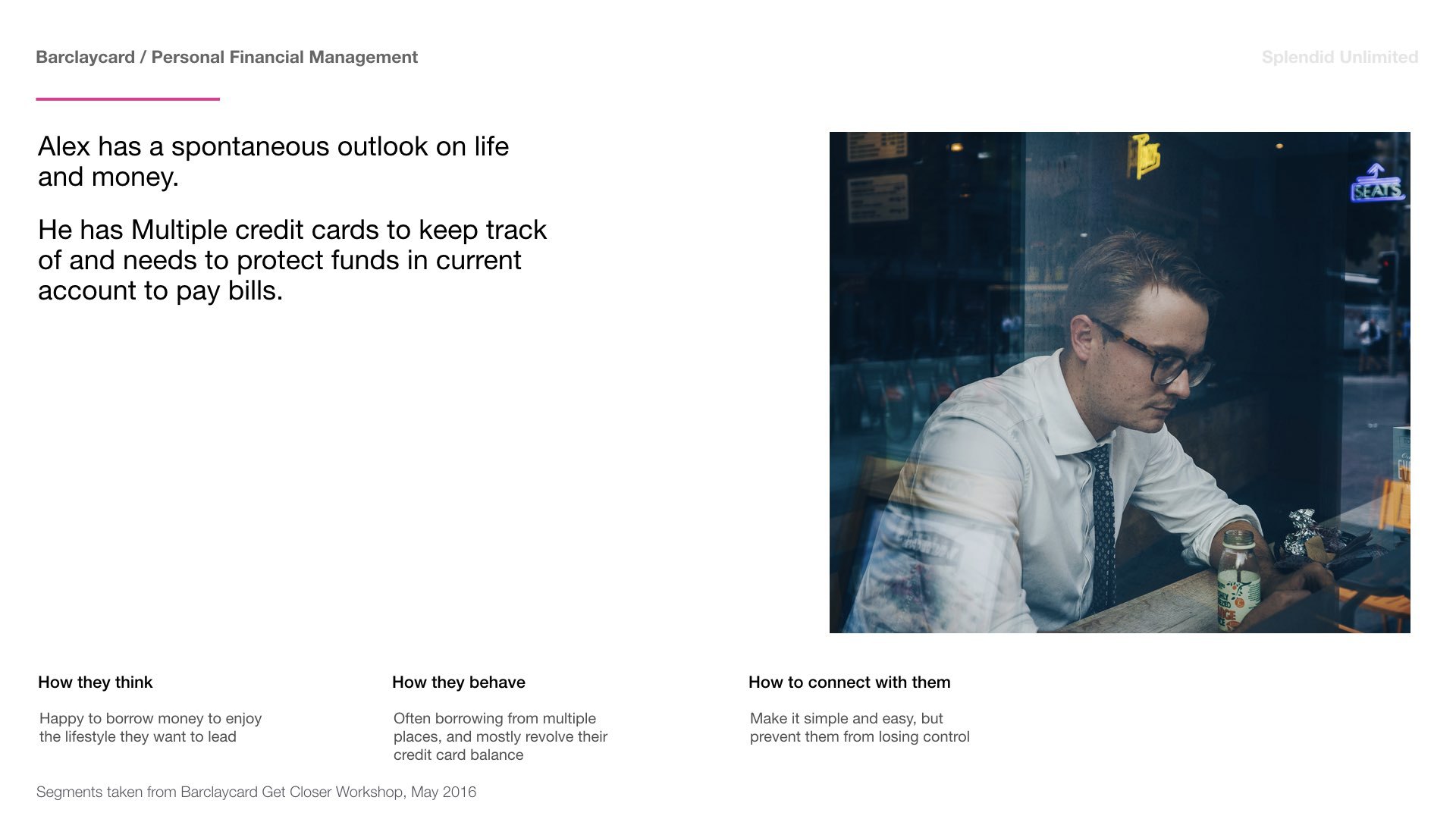

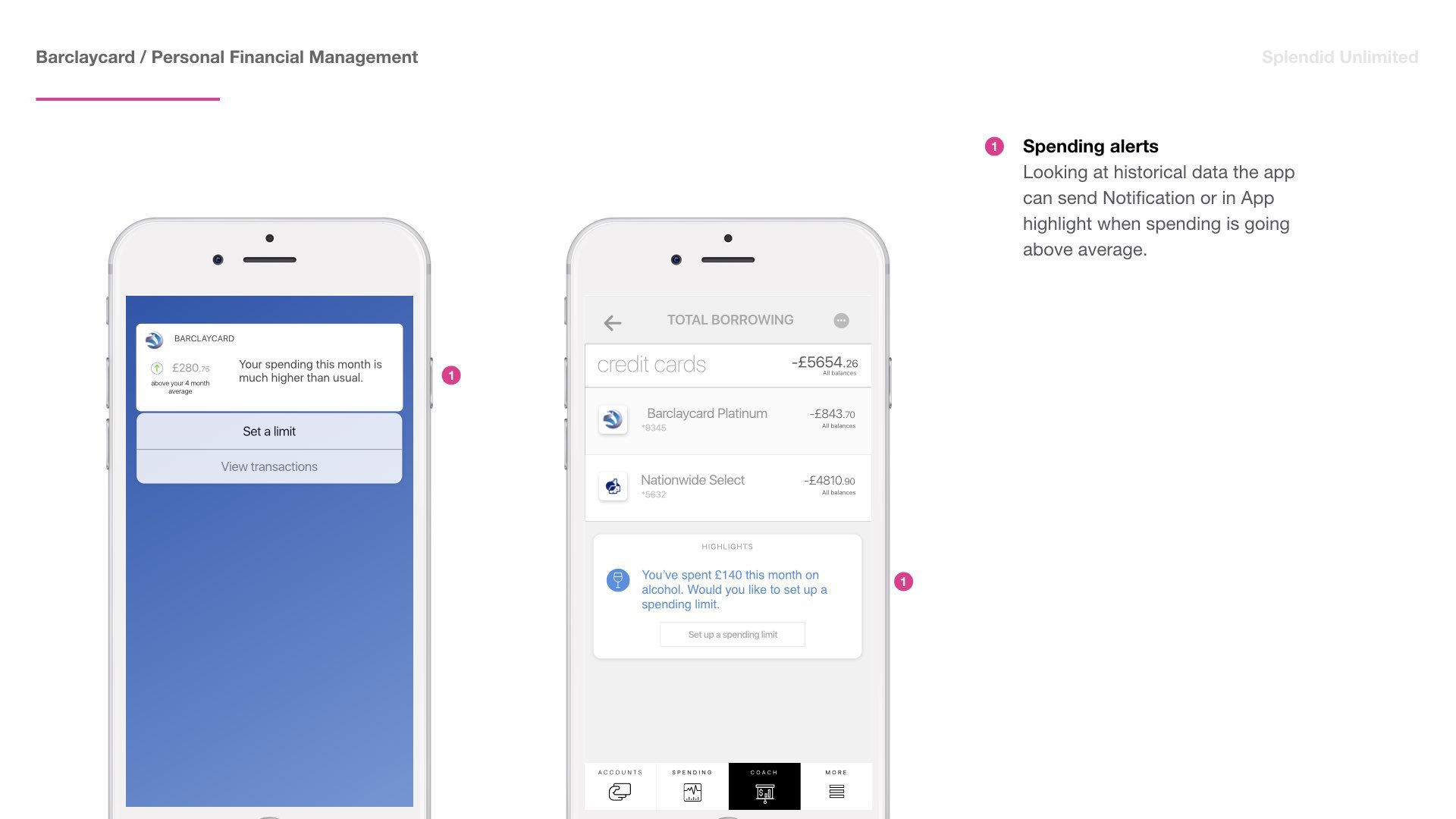

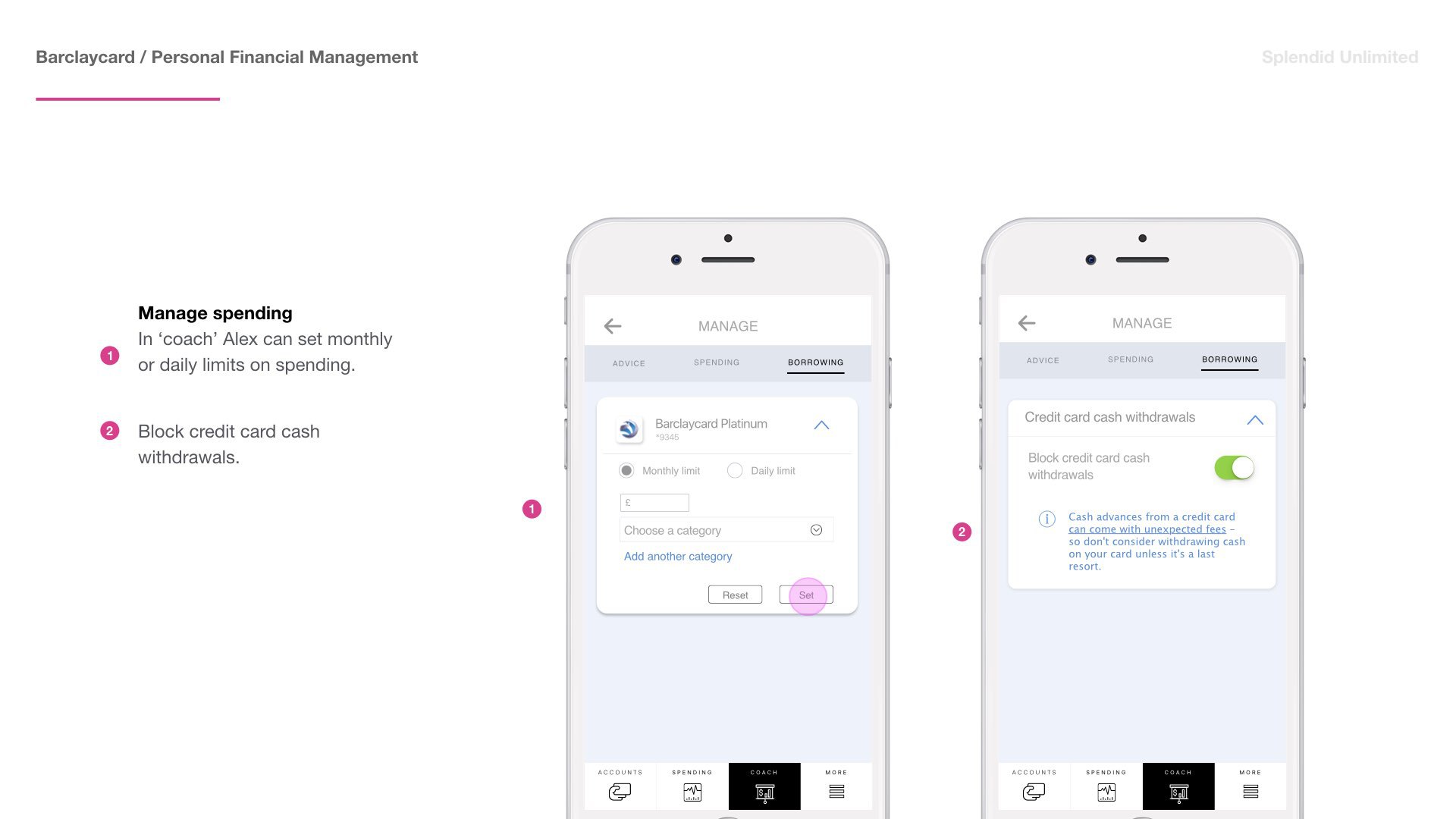

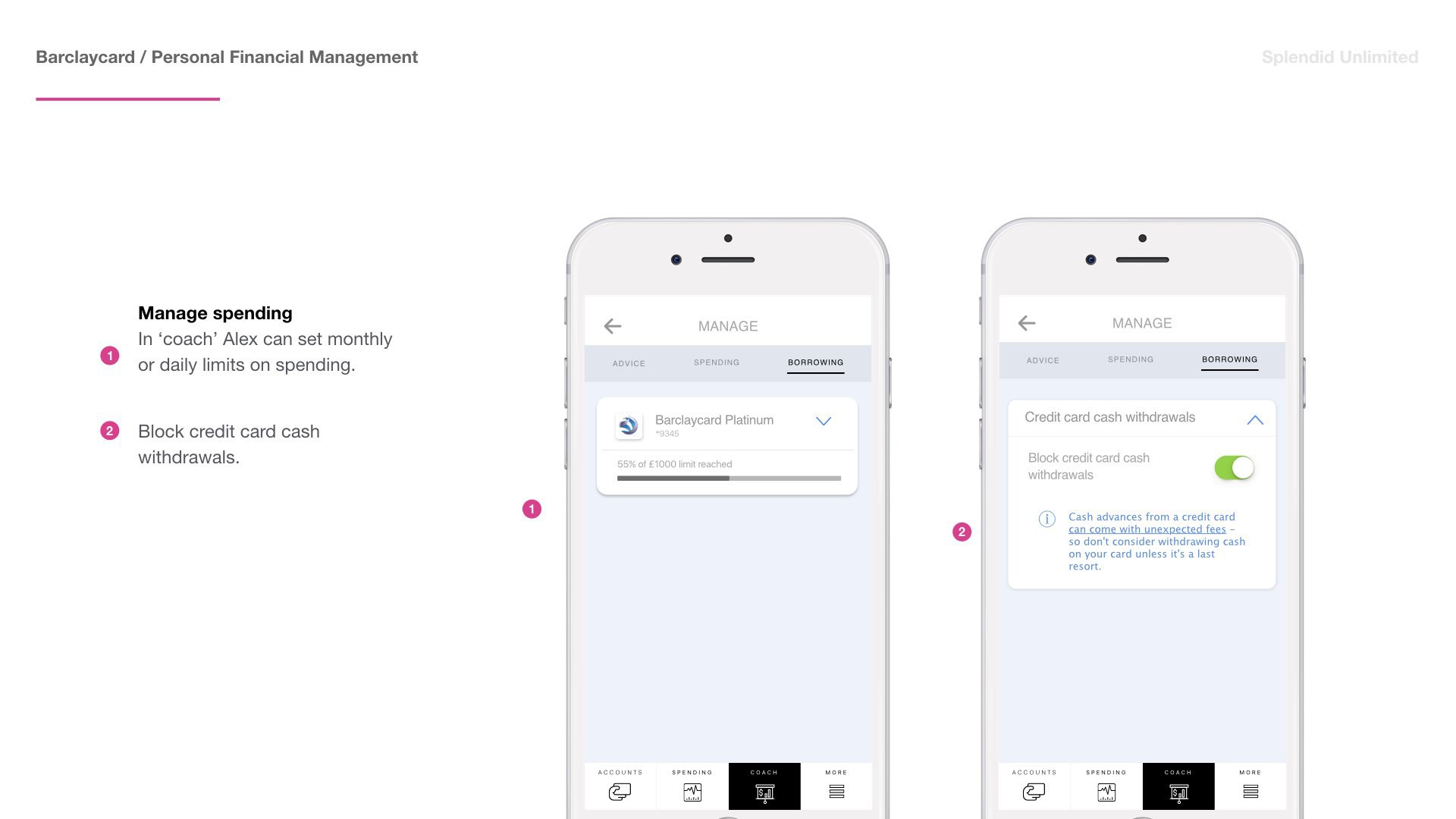

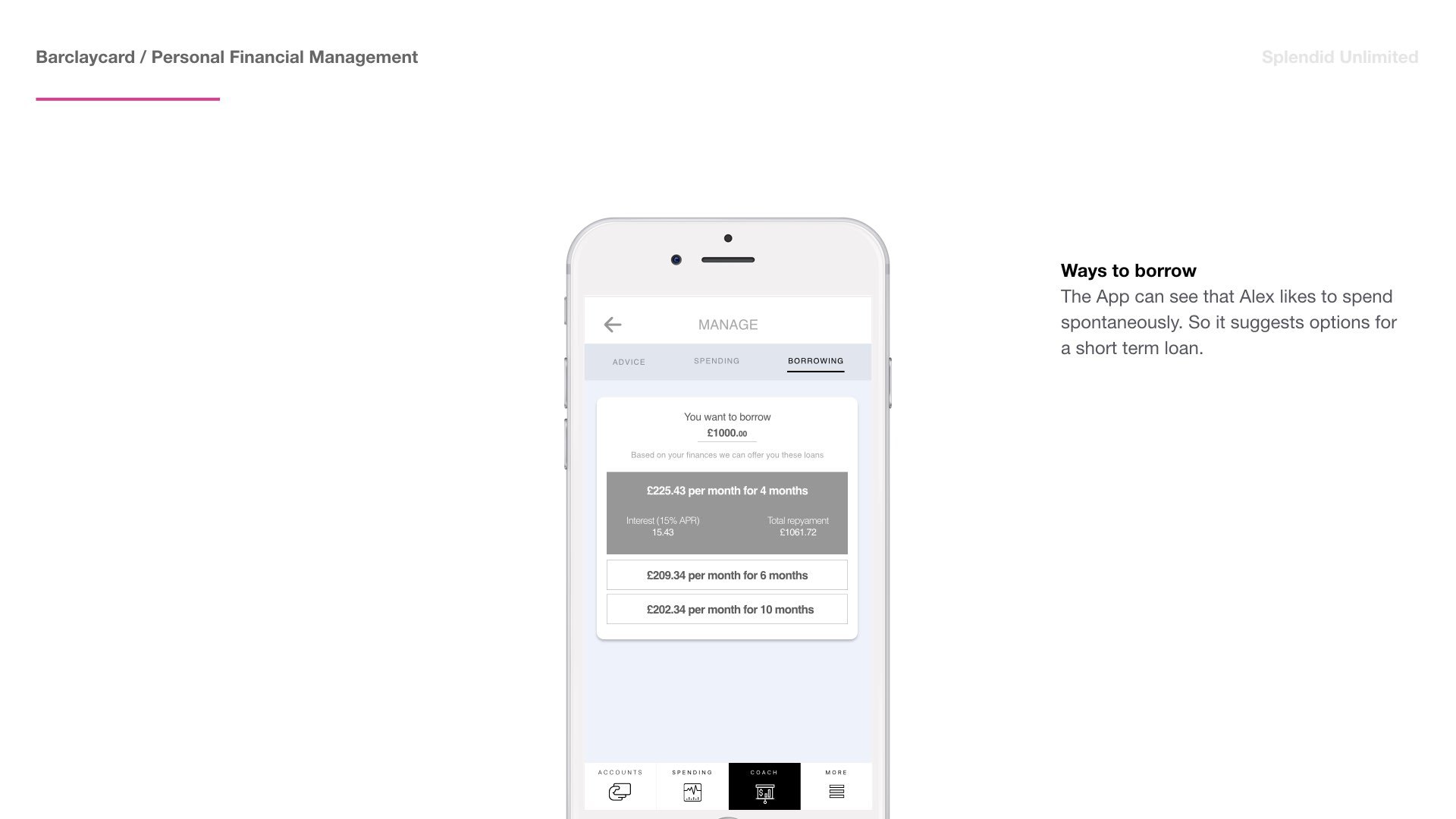

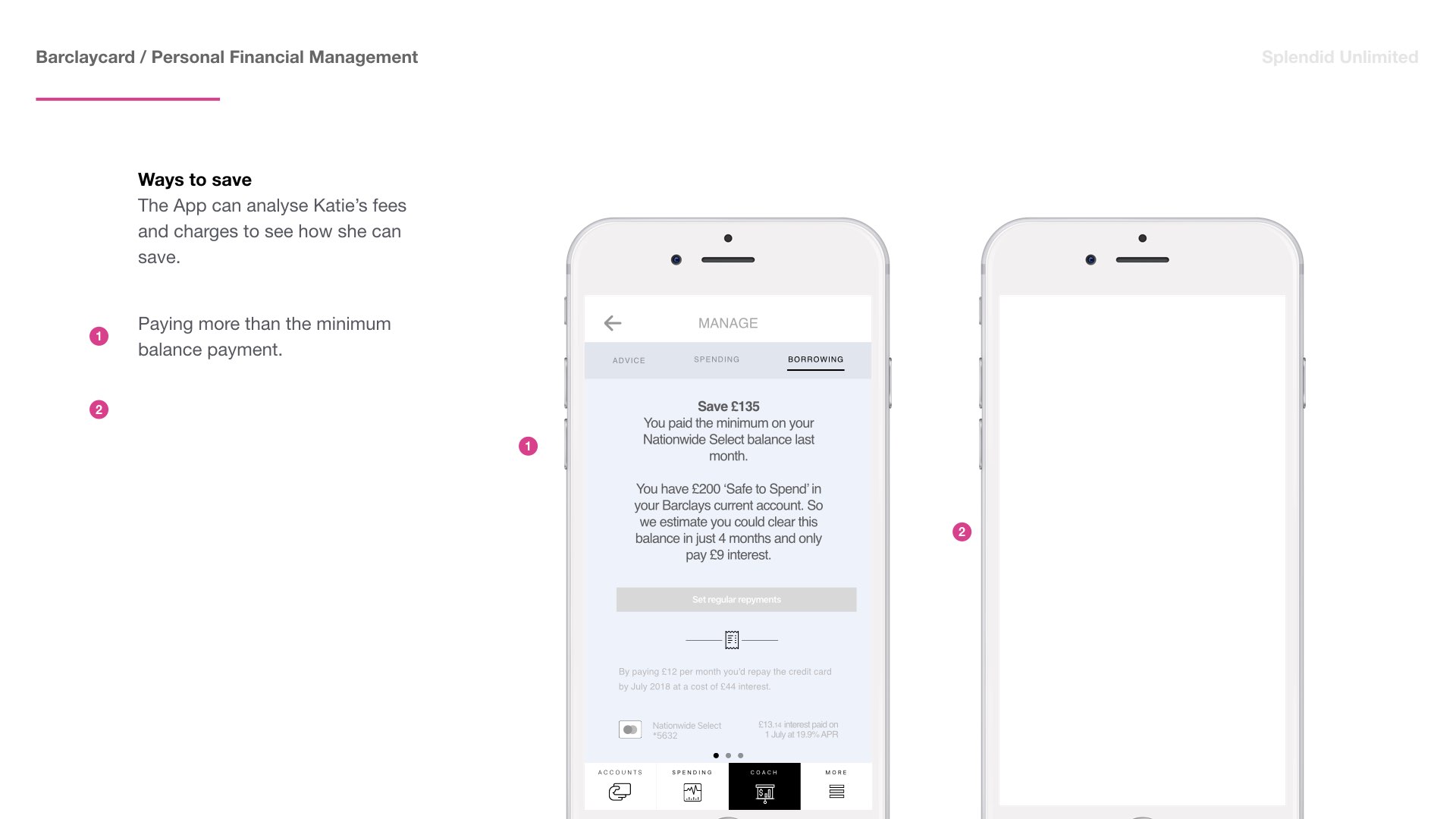

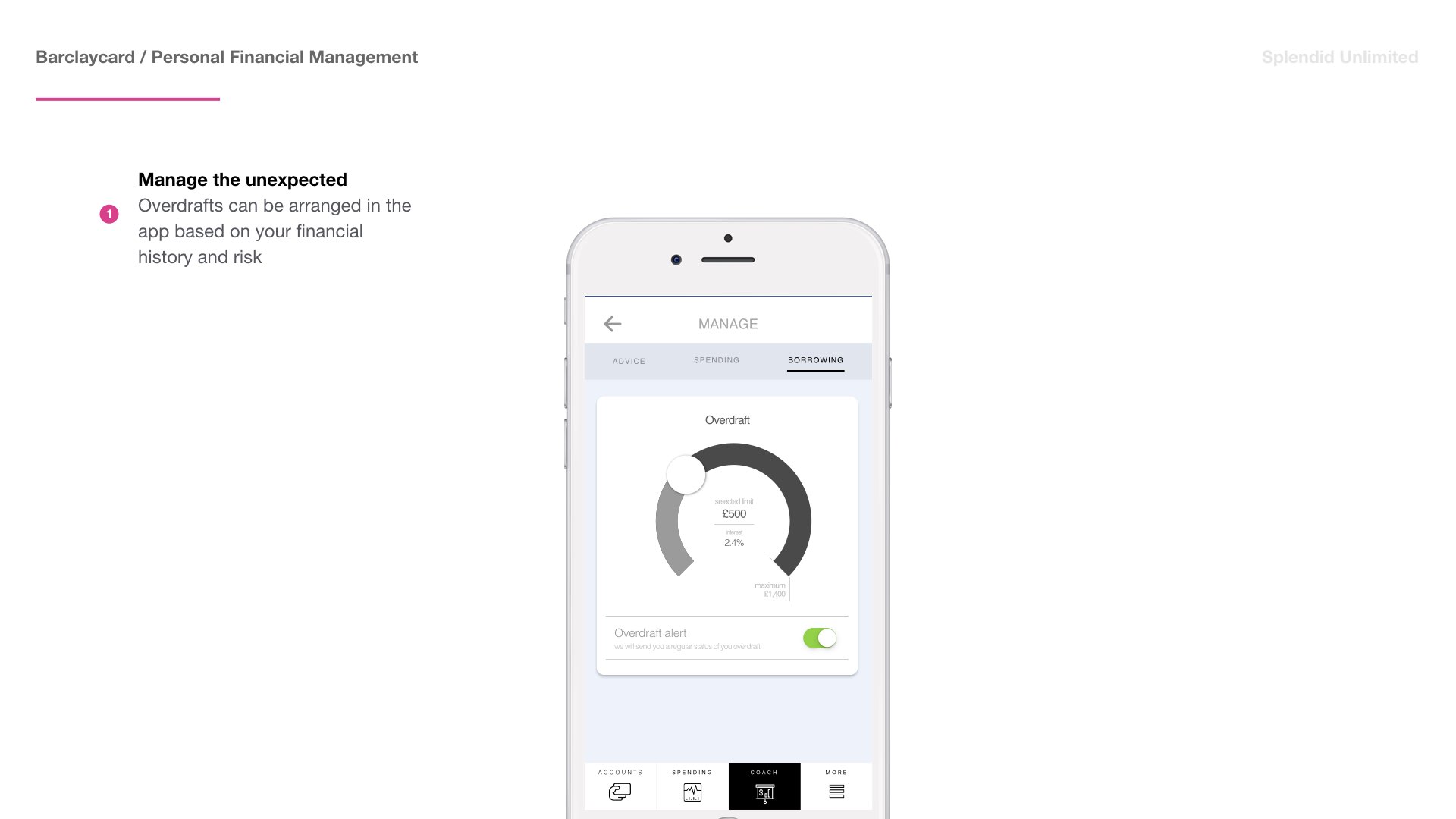

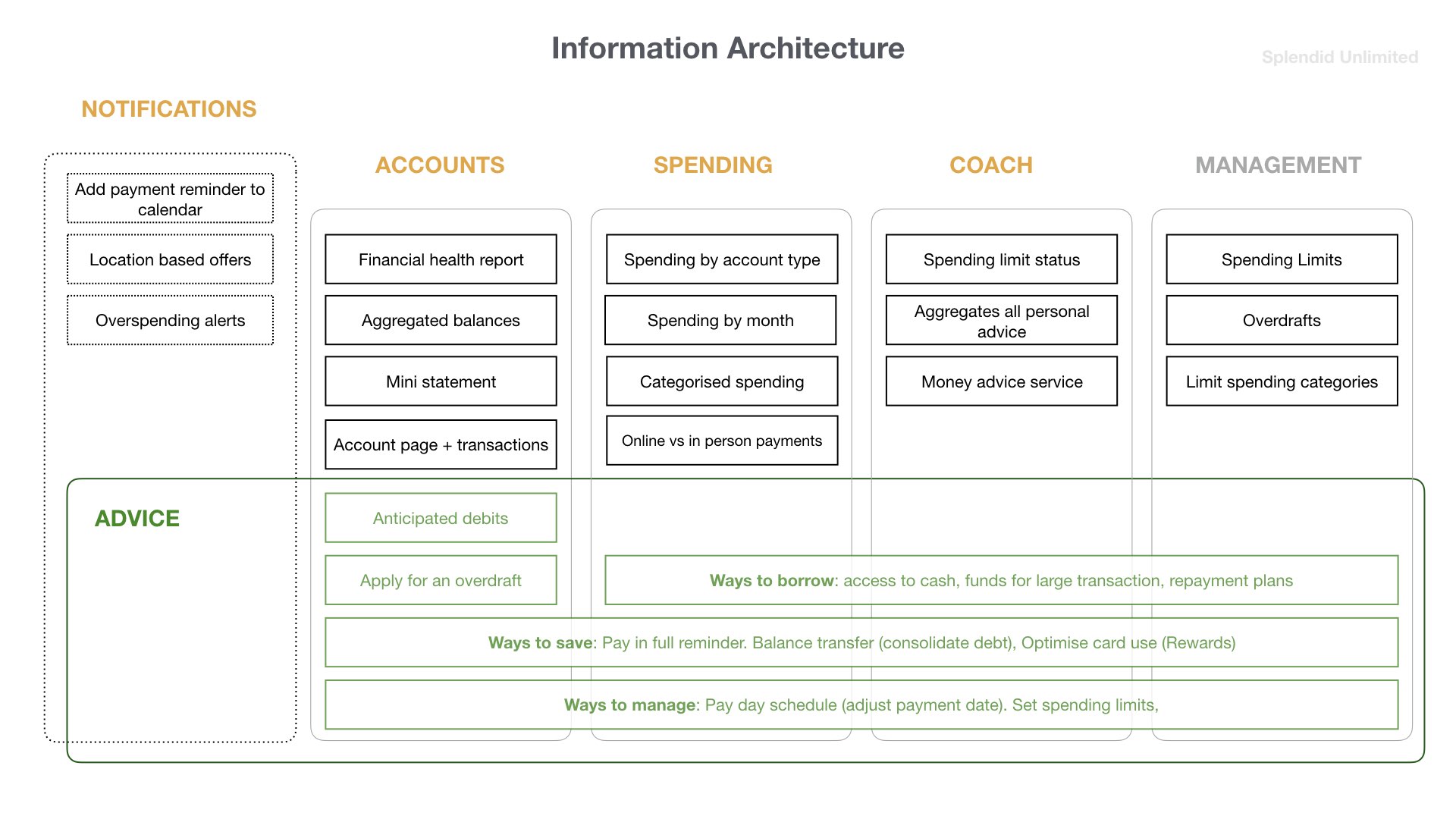

I created a presentation to animate through keyscreens and explain the framework of the concept. The key features of the app were validated in scenarios that solved typical user needs of various Barclaycard customer segments.

Results

- A research document to establish PSD2 legislation and its impact on established banks.

- A vision of a personal financial management service.

- Customer journeys illustrating how we could use a aggregated financial history to understand them and providing personalised financial support. This was created for four key customer segments of Barclays customers.